december child tax credit check

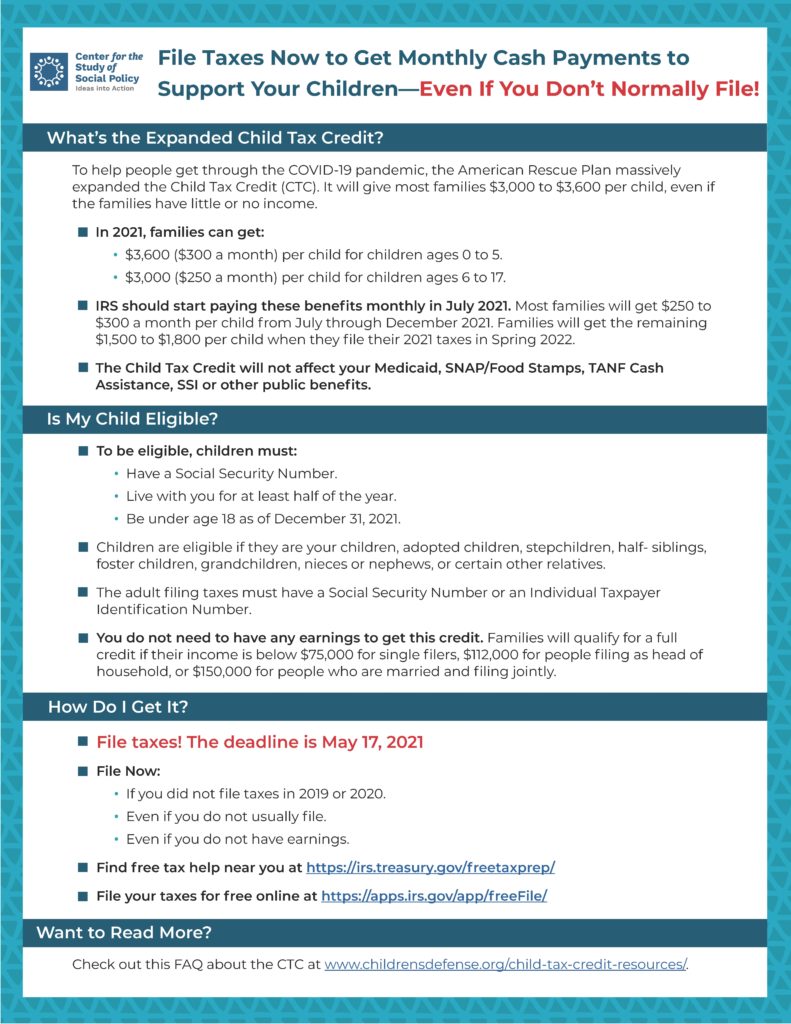

Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible. Instead of calling it.

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

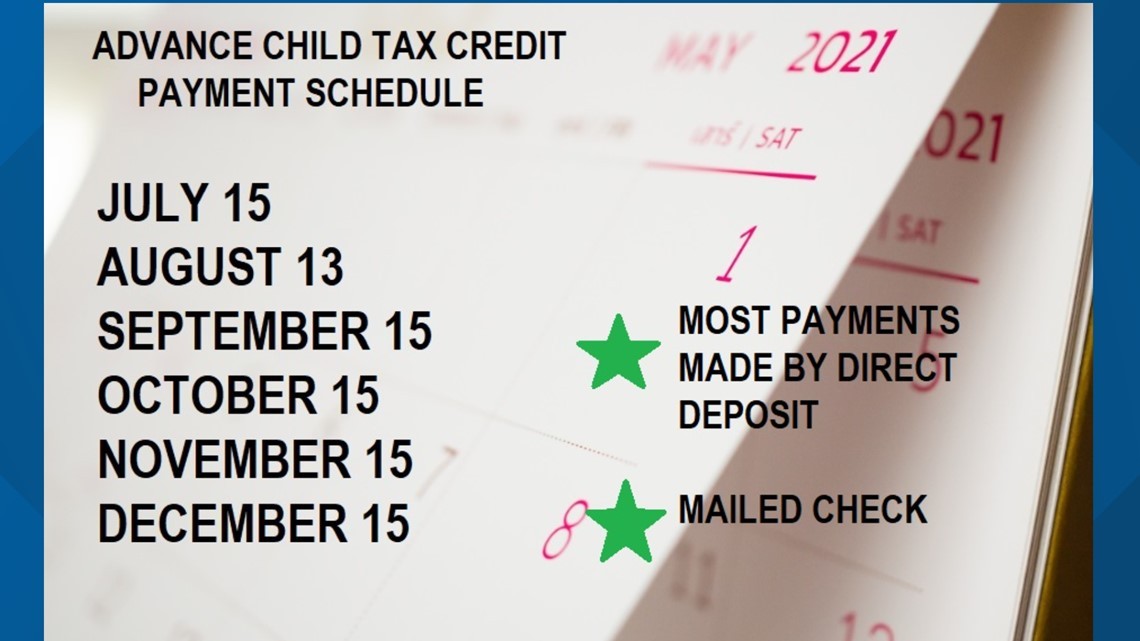

The next child tax credit check goes out Monday November 15.

. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. They can be forced to pay federal or state income taxes. 1200 in April 2020.

Half of the enhanced sum was made. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. The child tax credit wasnt new when Democrats over the objections of Republicans in Congress altered the program as part of Bidens 19 trillion coronavirus relief.

103 Center Street Perth Amboy NJ 08861 732 324-4357 Fax 732 376-0271 website. Community Child Care Solutions Inc. The existing credit of 2000 per child under age 17 was increased to 3600 per child under 6 and 3000 per child ages 6 through 17.

The child tax credits remaining balance may be taken from you if you are due a tax return in 2022. If your refund is less than 1000 you. The bill increased the child tax credit payment from 2000 per child to 3000 for children ages 6 through 17 and 3600 for children under 6.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. We are dedicated to providing the highest quality services in the most efficient manner possible to the business. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Government via stimulus checks extra unemployment. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. You are eligible for a property tax deduction or a property tax credit only if.

Welcome to the Division of Revenue and Enterprise Services DORES. 600 in December 2020January 2021. Have been a US.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. Millions of Americans have weathered the COVID-19 pandemic with the help of direct cash payments from the US. How to opt in.

Half of that money is being. However the deadline to apply for the child tax credit payment passed on November. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

Fourth Stimulus Check Cola 2022 Benefits Medicare Child Tax Credit Summary 25 December As Usa

All You Need To Know About The New Child Tax Credit Change

Child Tax Credit Fight Reflects Debate Over Work Incentives Wusa9 Com

Child Tax Credit Payments Are Ending In Less Than Two Weeks But Here S How You Could Still Get 1 800 More Per Kid The Us Sun

Child Tax Credit Close To Lapsing As December Checks Go Out Kvia

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Child Care Resources What S The Expanded Child Tax Credit

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Child Tax Credit Dates Last Day For December Payments Marca

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Final Check Child Tax Credit Payment For December Youtube

Families Face First Month Without Child Tax Credit Payments Since July Az Big Media

Remember That The Child Tax Credit Padden Cooper Cpa S Facebook

Monthly Child Tax Credit Payments To Start July 15 What You Need To Know Silive Com

Child Tax Credit Checks Will Start Arriving In July

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment